For first time buyer, it might not be so clear what is the total long term cost being incurred when invests in mutual fund. The most prominent fee that capture attention of consumer no doubt is annual management fee. Typically in Malaysia, an equity fund commands annual management fee of 1.5% while bond fund charges a lesser fee of 1%. As a matter of fact, running a mutual fund involves costs, including shareholder transaction costs, annual trustee fee, investment advisory fees, operation fees, marketing, distribution expenses and etc. Those misc fees together with annual management fee make up the real cost of holding mutual funds. Annually this expense materializes as an expense ratio which is in nutshell merely "annual operating expenses divided by average annual net assets."

For first time buyer, it might not be so clear what is the total long term cost being incurred when invests in mutual fund. The most prominent fee that capture attention of consumer no doubt is annual management fee. Typically in Malaysia, an equity fund commands annual management fee of 1.5% while bond fund charges a lesser fee of 1%. As a matter of fact, running a mutual fund involves costs, including shareholder transaction costs, annual trustee fee, investment advisory fees, operation fees, marketing, distribution expenses and etc. Those misc fees together with annual management fee make up the real cost of holding mutual funds. Annually this expense materializes as an expense ratio which is in nutshell merely "annual operating expenses divided by average annual net assets."

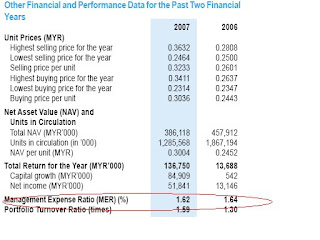

This is no way fund house is hiding this figure from investors. This figure can be obtained in their annual report and updated prospectus. The irony is investors more interested in the yearly gain instead of figures being shown in balance sheet and new buyers are often sold to newly launched funds. This ratio need at least a year worth of data to compute.

So why does it matter? Well if under same fund category, it serve as a factor to take into consideration to choose a fund to invest in. The one with higher MER will erode more of your yearly gain and the fund manager in fact need to work harder to beat the index to justify the asking price.

No comments:

Post a Comment